south dakota property tax exemption

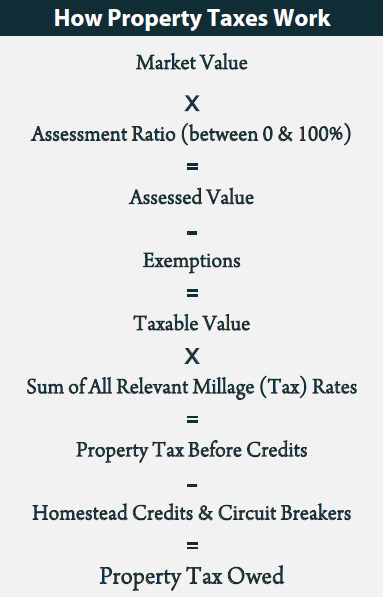

Application for property tax exempt status sdcl 10-4-15 application must be filed with director of equalization by november 1 for consideration during county board of equalization the following. Then the property is equalized to 85 for property tax purposes.

All applicants must provide proof of their eligibility for this.

. Is the above described property classified in the county director of equalization office as owner-occupied. If you have questions please contact your local County Director of Equalization. Other South Dakota property tax exemptions include the disabled veterans exemption which exempts up to 150000 of the disabled veterans property value from taxes.

For land to be classified as agricultural it must meet the following criteria. If you have questions check out our Disabled Veteran Property Tax Exemption Brochure or feel free to call our Property Tax Agents at 1-800-829-9188 Option 2. Property tax exemptions allow businesses and homeowners to.

The states laws must be adhered to in the citys handling of taxation. Not exempt Minnesota motels and hotels are not exempt North Dakota Ohio and West Virginia. South Dakota Property Tax Exemption for Disabled Veterans.

If a disabled military. Property Tax Exemption for Veterans and their Widow or Widower. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised.

South Dakotas median income is 56323 per year so the median yearly property tax paid by South Dakota residents amounts to approximately of their yearly income. SDCL 10-4-2410 states that dwellings or parts of multiple family dwellings which are specifically designed for use by. Applications for these reductions or exemptions can be obtained from and returned to this office or can also be obtained at the SD Department of Revenues links below.

The property subject to this exemption is the same property eligible for the owner-occupied classification To be. Taxation of properties must. The first 50000 or 70 percent of the assessed value of solar energy systems less than 5 MWs whichever is greater is exempt from the real property tax.

Exempts up to 150000 of the assessed value for qualifying property. South Dakota property tax credit. South Dakota Property Tax Exemptions for Energy South Dakota offers property tax exemptions for installed solar systems.

The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would. South Dakota Property Tax Exemption South Dakota state law SDCL 10-4-44.

The governments from states without a sales tax are exempt from South Dakota sales. The primary and main use of the land must be devoted to agricultural pursuits such as the harvesting of crops or the. Beginning in 2021 biomass fuel stoves are also included in tax credits for residential renewable energy products.

South Dakota offers a partial property tax exemption up to 150000 for disabled Veterans and their Surviving Spouse. As a 100 PT disabled veteran South Dakota provides a property tax exemption up to 150000 that reduces the taxable value of a veterans home. Instead of calculating your property tax percentage based on the full value of your home the Idaho Homeowners Exemption subtracts 100000 and determines your tax rate based on the.

Assessment Freeze For The Elderly Disabled South Dakota Department Of Revenue

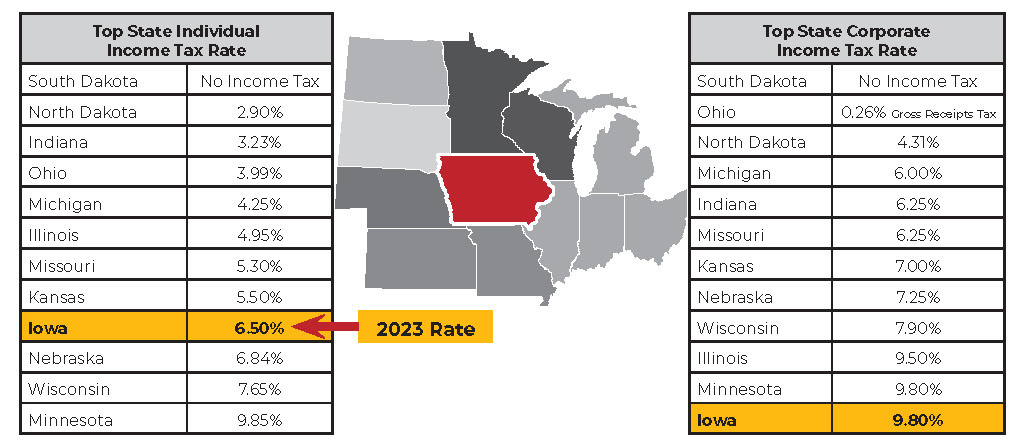

Iowa Still Has High Income Tax Rates Iowans For Tax Relief

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

South Dakota Department Of Revenue Facebook

Economic Nexus And The Future Of Sales Tax Youtube

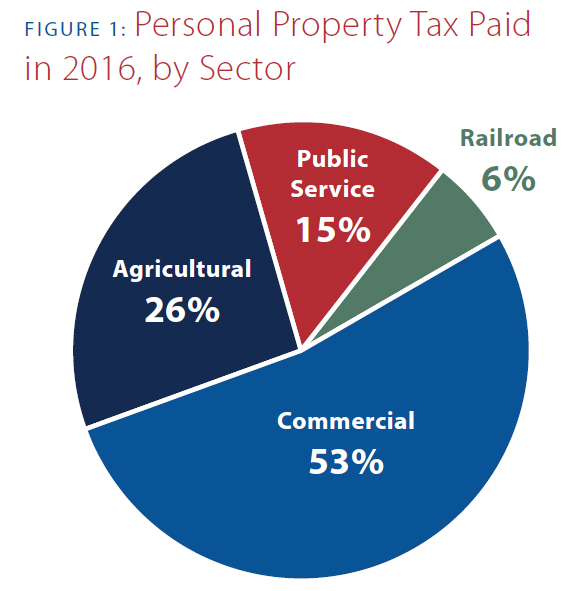

States Moving Away From Taxes On Tangible Personal Property Tax Foundation

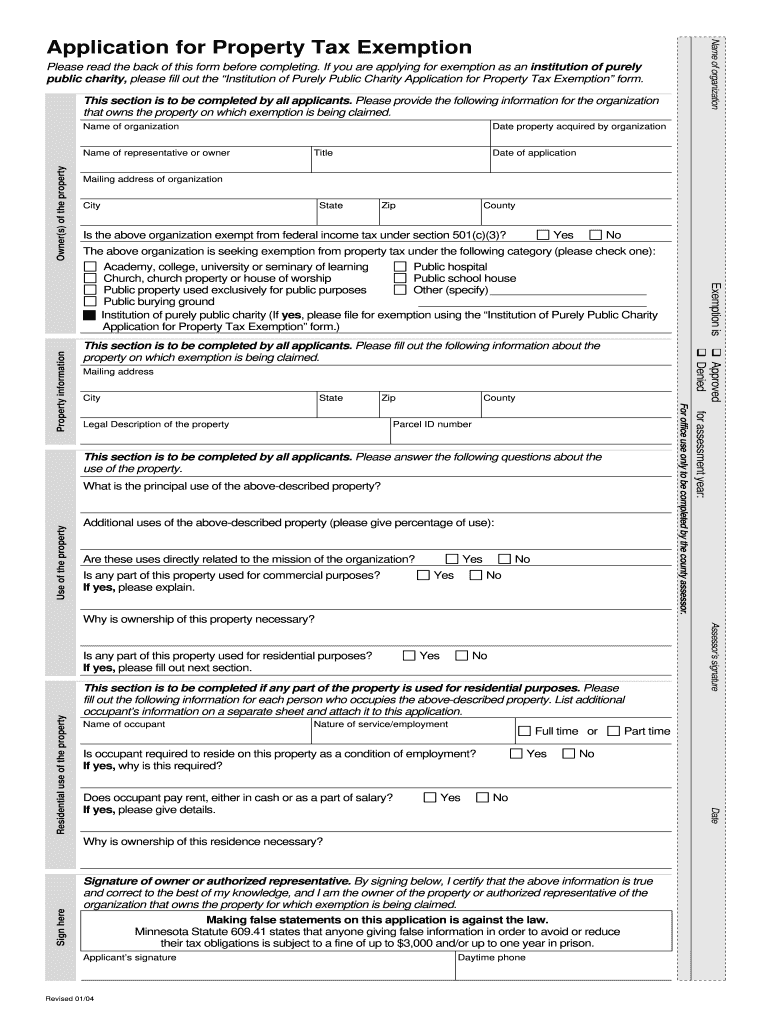

Form Pt 43 Fillable Application For Property Tax Exempt Status

Veteran Tax Exemptions By State

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Port There S A Way We Could Have Property Tax And Income Tax Cuts

Top 9 South Dakota Veteran Benefits Va Claims Insider

Mn Application For Property Tax Exemption Carver County 2004 2022 Fill Out Tax Template Online Us Legal Forms

South Dakota Estate Tax Everything You Need To Know Smartasset

Property Tax South Dakota Department Of Revenue

Department Of Revenue Reminds Homeowners Of Property Tax Relief Deadline Knbn Newscenter1

What States Do Not Have Property Tax Quora

State Tax Treatment Of Homestead And Non Homestead Residential Property